Ever wonder where in Europe you’d need a millionaire’s salary just to afford a decent home? While Europe is rich in charm, history, and quality of life, it’s also home to some of the priciest real estate markets on the planet. From the snow-capped peaks of Switzerland to the polished streets of Luxembourg, buying a home in certain countries can feel more like entering an elite club than simply putting down roots.

In this post, we’re diving into the hard numbers—comparing average house prices, incomes, and affordability across the continent—to reveal the most expensive countries to buy a house in Europe. Whether you’re in the market to buy a house, looking to move to another country, or just love some good real estate drama, you’ll want to see which countries top the list (and which ones to avoid if you’re house-hunting on a budget).

Dreaming of a cozy chalet in the Alps? A modern Nordic hideaway? Maybe a sun-drenched villa in France? Europe is full of Pinterest-worthy places to call home—but the cost of turning that dream into reality depends heavily on where you’re looking.

We crunched the numbers on average housing prices, household incomes, and how many years of salary it would take to afford a home across ten European countries. The results? Some countries will stretch your budget like a yoga class in Zurich—others might surprise you with their value.

Top 10 most expensive countries in Europe to buy property

Here’s a quick look at the top 10 countries with the most expensive houses based on the average price of a 200-square-meter house:

- Switzerland – €1,760,000

- Luxembourg – €1,640,000

- Austria – €1,180,000

- Norway – €980,000

- Denmark – €880,000

- Sweden – €780,000

- France – €760,000

- Netherlands – €720,000

- Ireland – €620,000

- Germany – €620,000

But what do those numbers actually mean when compared to local incomes—and what could it mean for your lifestyle?

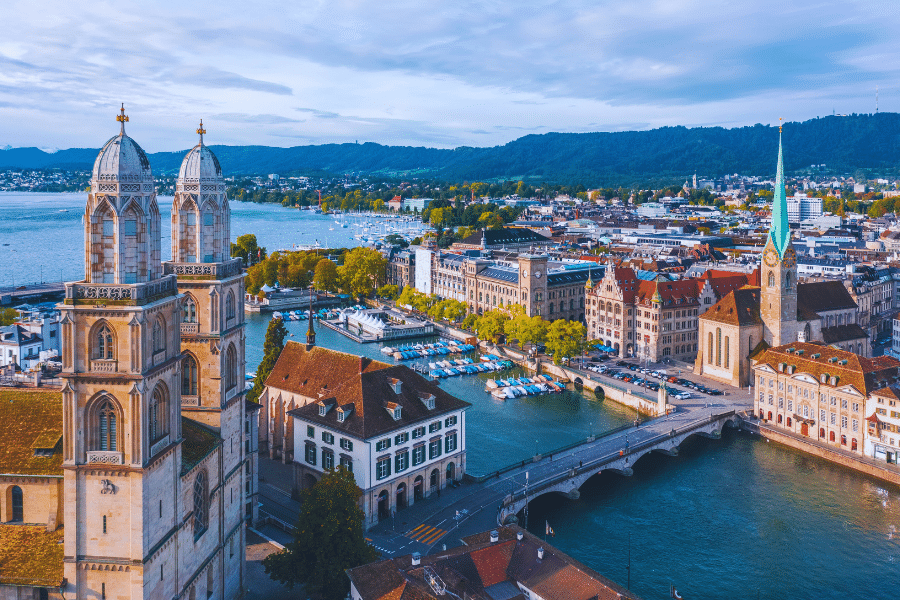

Million-Euro Views, Million-Euro Mortgage

Let’s start with the heavyweights. If your heart is set on Switzerland, get ready to dig deep. The average home costs €1.76 million, and even with a high household income (€177,600/year), it’ll take around 10 years of earnings to buy one.

Luxembourg is close behind with €1.64 million homes and a price-to-income ratio of 11. Ouch. Austria, while slightly more affordable, still requires a similar ten-year stretch of your salary to pay for a typical home.

These countries offer high quality of life—but also high financial barriers to entry. Gorgeous? Yes. Budget-friendly? Not so much.

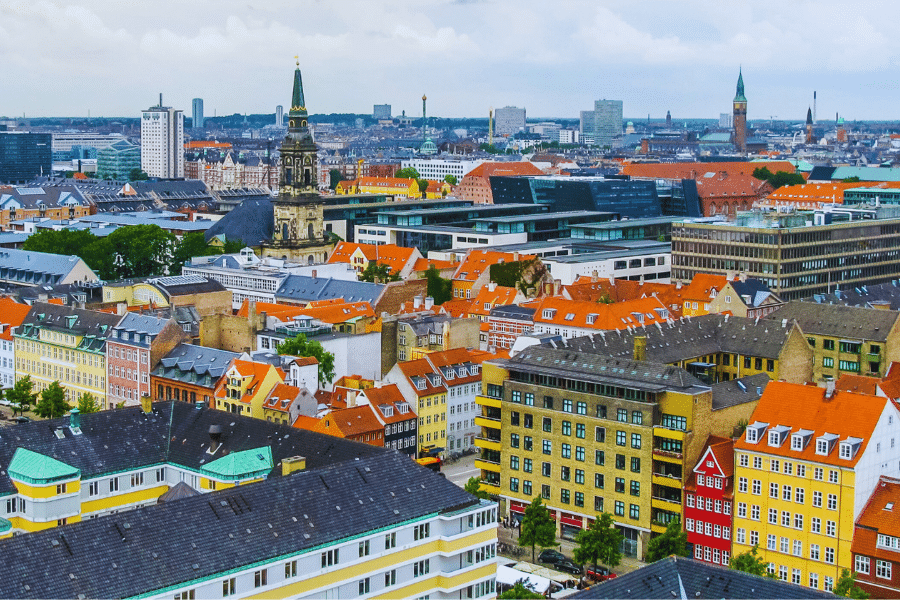

Scandinavia: Not Cheap, But Balanced

Heading north, the numbers start to chill out a bit. Norway offers strong incomes and slightly better balance: €980,000 per home with a price-to-income ratio of 9. Not exactly a steal, but more manageable.

Denmark stands out here. With €880,000 homes and a relatively low ratio of 6, it offers a nice blend of Nordic charm and affordability. Sweden is close behind, at €780,000 per home and an income ratio of 8—still high, but more in line with what many households can handle.

Western Europe: A Mixed Bag

France and the Netherlands both sit in the middle of the spectrum. French homes average €760,000, with an income ratio of 8, while the Dutch market is a touch cheaper at €720,000 and a better ratio of 6.

In both countries, you’ll still need to plan and budget carefully—but you’re not facing the extreme numbers of central Europe or Switzerland.

Value Picks: Germany and Ireland

Here’s the good news: if you’re looking for value without sacrificing quality of life, Germany and Ireland are your best bets.

Germany: €620,000 average house price, household income €117,600, ratio 5

Ireland: €620,000 average house price, household income €134,400, ratio 5

That means it would only take about five years of household income to buy a home. Compared to Switzerland or Luxembourg, that’s like getting two houses for the price of one—and with solid infrastructure, lifestyle perks, and cultural richness, both countries are major wins.

Best countries to buy a house in Europe with the ideal price to income ratio

If you’re dreaming of owning a home in Europe without signing your life away to a mortgage, you’ll want to look beyond the glittery price tags and focus on one key number: the price-to-income ratio. This little metric tells you how affordable housing really is in a given country—and it turns out, some of the best places to buy a home aren’t where you’d expect.

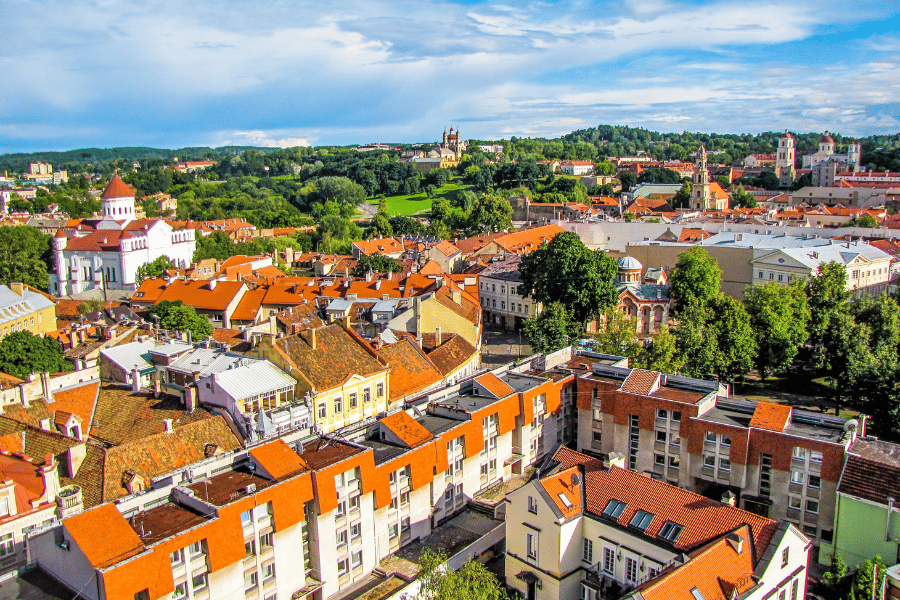

Lithuania takes the top spot as Europe’s most affordable housing market, with a price-to-income ratio of just 4. That means the average household could afford a home in just four years of income—a rarity in today’s market. With house prices averaging €220,000, Lithuania is an underrated gem for anyone looking to settle down in a fast-growing country with a mix of charming cities, Baltic beaches, and a low cost of living.

Next up are Ireland and Germany, where the numbers strike a beautiful balance between strong incomes and higher property values. Homes here go for around €620,000, but with average household earnings over €130,000 in Ireland and €117,000 in Germany, buyers aren’t overstretching themselves. Add in the lifestyle perks—think lively cities, excellent healthcare, and career opportunities—and it’s easy to see why these countries are attracting both locals and expats ready to put down roots.

And if you’re still weighing your options, don’t overlook Italy, the Netherlands, or even Romania. With a price-to-income ratio of 6, these countries offer a solid mix of affordability and lifestyle. Whether it’s the slow pace of Tuscan living, the bike-friendly urban buzz of Amsterdam, or the up-and-coming energy of Bucharest, there’s a version of the good life that won’t drain your wallet.

Leave a Comment