Spain has announced plans to end its golden visa program, which grants Spanish residency to foreigners who invest in real estate, starting from 2024. The decision comes as part of the government’s efforts to increase the availability of affordable housing for locals and ensure that housing is treated as a right and not just a speculative business.

The Spain golden visa scheme, introduced in 2013, aimed to revitalize the property sector following a housing market crash and euro currency crisis. However, it has been criticized for putting inflationary pressure on the economy and serving as a back door for illicit funds.

The Spanish government has cited the need to address the housing crisis and provide affordable homes as the main reasons for ending the golden visa program. The country has granted over 14,000 golden visas since the program’s inception, with the majority going to Chinese and Russian citizens. The government has also expressed concerns over corruption, money laundering, and tax evasion associated with the program.

How do you obtain a Golden Visa while it’s still in effect?

To qualify for a Golden Visa in Spain, applicants must be over the age of 18, obtain valid health insurance in Spain, have enough financial means to sustain themselves and any family members, have a clear criminal history, not be listed on Spain’s list of undesirable people, have no rejected Schengen Visas, and make a significant investment in the country.

The investment options for a Golden Visa in Spain include investing at least €500,000 in real estate property, investing at least €1,000,000 in shares in a company or deposit in a Spanish bank, or investing at least €2,000,000 in the Spanish public debt.

Get the scoop on how to buy property in Spain as a foreigner.

Buying real estate in Spain is the favorite option

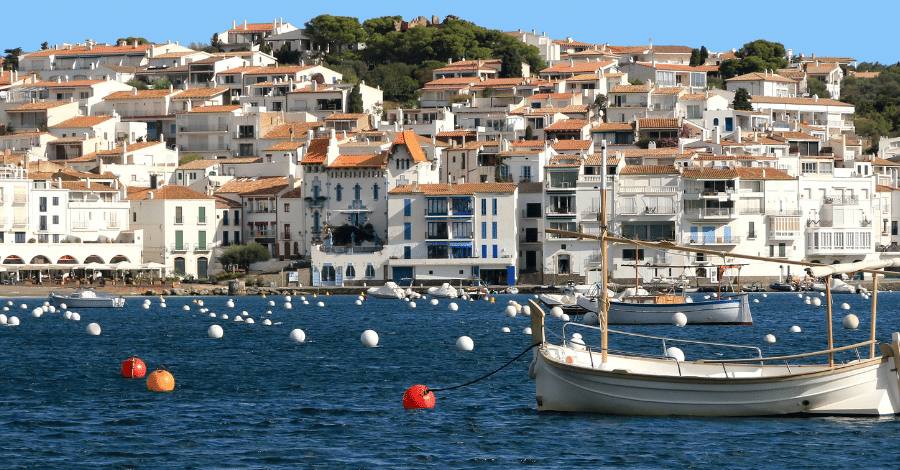

Buying a house is the most popular option for obtaining a Golden Visa in Spain, with applicants required to invest at least €500,000 in property. This investment can be in residential or commercial property and can be spread out into multiple properties anywhere in Spain. The homes may be rented out, and different buyers may combine their investment into one property.

Other programs may be replacing the golden visa

The Spanish government is considering two alternatives for the Spain Golden Visa program: abolishing it altogether or doubling the minimum investment amount required to €1 million.

The proposal to abolish the program comes from the center-left political party Más País, which argues that Spanish citizenship cannot be bought and that the scheme has contributed to a “brutal” increase in house prices, forcing residents out of their neighborhoods.

The Social Security Ministry has reportedly agreed to bring an end to the scheme, and the government’s junior coalition partner Sumar has also voiced support for scrapping it. However, no official agreement to end the scheme has been reached, and the government is considering tougher requirements for applications.

The proposal to double the investment amount required for the program is also being considered.

Spain aligns with what is happening in other European countries

The decision to end the golden visa program reflects a wider trend in Europe, with countries such as Portugal and Greece having already revamped or ended similar schemes. The European Commission has also advocated for the termination of these visa schemes, citing security risks and the lack of a requirement for beneficiaries to reside in the country.

Several European countries have ended or modified their golden visa programs. These include Ireland, Portugal, the United Kingdom, Montenegro, and the Netherlands.

Golden visa programs in Europe have been terminated for several reasons, primarily due to security concerns, money laundering risks, and their impact on housing affordability. The European Commission has been critical of these programs and has taken steps to discourage their establishment and shut down existing ones.

In Portugal, the most popular and attractive golden visa program, the government terminated it due to housing affordability issues. Although golden visa buyers represent a small percentage of overall property buyers in Portugal, the government used the program as a scapegoat to address housing affordability concerns.

The new law, which still needs the president’s signature, allows existing golden visa holders to keep their visas under the same terms but purchasing property will no longer grant residency. Investors can explore other options, such as investing in Portuguese culture or heritage, scientific research, or businesses that create jobs.

Ireland also terminated its golden visa program due to concerns over wealthy Chinese buyers using the program to gain access to the European Union, which could be a stick for opposition parties to beat the government with. The program only allowed investments in Irish REITs, not physical property.

Housing prices may see some relief, but not much

The end of Spain’s golden visa program is expected to have a limited impact on the property market, as less than 0.1% of homes sold since 2013 were purchased under the scheme. We may notice some changes in housing prices in the most popular areas for investment, tourism-focused towns and cities or coastal areas with vacation homes.

The termination of the program could potentially lead to a stabilization or even a decrease in housing prices in Spain, as the demand from foreign investors who were utilizing the golden visa scheme to purchase property may decrease.

The government’s hope is that the decision could lead to a more balanced housing market, making it more affordable for Spanish citizens to buy homes and reducing the risk of speculative price increases driven by foreign investment.

Spanish and EU citizens will benefit the most when the Golden Visa goes away

In the long term, the end of the golden visa program could have positive effects for both Spanish citizens and EU citizens. Spaniards may benefit from a more stable and affordable housing market, with less competition from foreign investors. This could lead to a more sustainable real estate sector that is less prone to sudden price fluctuations.

Additionally, EU citizens looking to invest in Spanish property may find more opportunities and less competition, potentially leading to a healthier and more diverse real estate market in Spain.

Still interested in purchasing property in Spain? Discover where you can find the cheapest and most expensive house prices in Spain.