Buying a house in France becomes a very appealing idea to many non-French people every year – either as a vacation or retirement home. It is certainly something that can be done by non-EU foreigners who are living in France as long as they meet certain requirements. Following Brexit, there have been some important changes concerning British people wanting to invest in French property, regarding the length of time they can reside in France and it is important to apply for the correct documentation in good time.

Whether you’re new to France or have been renting in France for a while and are ready to commit to buying a home, there are a few important considerations to keep in mind.

The French real estate market is not as highly digitized as in the US, UK, Canada, or Australia. There are some regional chains with good websites, although 360º video tours are in their infancy in France. Many smaller family-run companies do not have websites and there are only a few really good national websites displaying properties with various agents, so it is difficult to complete in-depth research from the comfort of your couch.

A number of French property owners sell their property privately to avoid the French real estate agents’ commission which is usually between 3.5% – 7%. If you have a particular area that you like, it may be worth driving around looking for a homemade sign on the gate declaring ‘À Vendre’ or ‘AV’.

Why are French property prices so much lower?

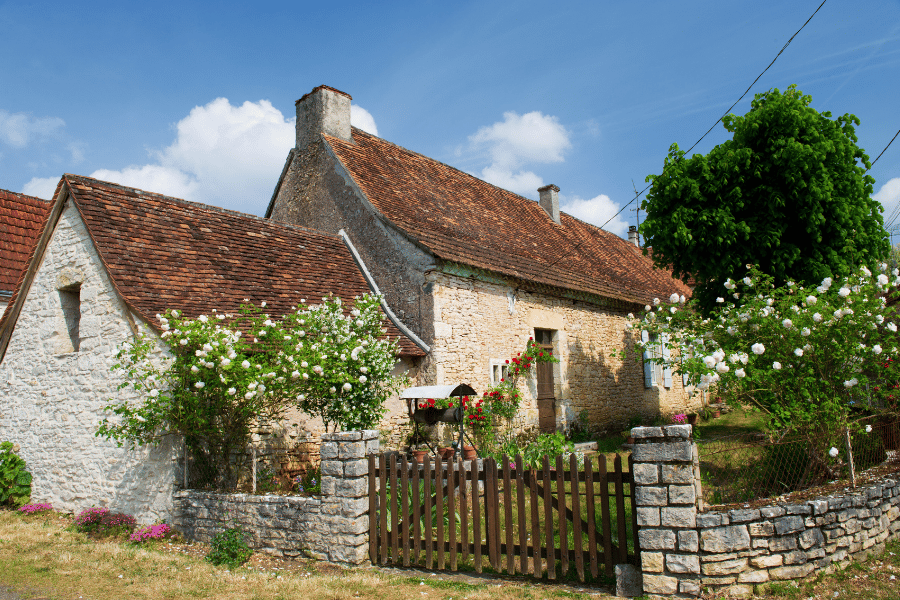

France is a really large country with plenty of space. In recent years, more and more people have relocated to the towns and cities and while the prices have increased in them along with pressure on the property market, in the larger rural communities, an increasing number of properties are being put on the market at very reasonable prices. If you are prepared to invest in a ‘project’ – that is a house that needs some renovation and modernization, there are some real bargains available.

What is the process to buy a house in France?

Step 1: Decide the checklist for your house

It is important to draw up a list of specific requirements you have for your property. This should include the location where you want to live – town or rural, price, what house size, and whether you are prepared to do some renovation work on the house.

Important points to consider before buying a home in France:

- Do you want the building to be on one level?

- If it is on two levels, would you like one of the bedrooms to be situated downstairs?

- How many bathrooms does the property have? En-suites are still uncommon in older properties.

- Does the property have a main drainage or does it have a Fosse Septique (septic tank)?

- Does the property have good mobile/ internet strength? Is it on fibre?

- Does the property have double glazing and insulation?

- Does the property have central heating?

- Would you like a large garden and swimming pool.

- Would you like a garage and good off-road parking?

- Would you like outside storage areas for lawn mowers and other gardening equipment?

And points to consider about the vicinity:

- Distance to shops, supermarkets and other amenities.

- Are there good medical facilities nearby? Doctors, hospital, dentist etc.

- Good public transport system.

- Are there other English-speaking families in the town/village?

- Is there an Anglo-French club, craft club or similar?

- Is the distance to regional airports or the Channel ports an important factor?

- Are there good sports facilities nearby e.g. tennis courts, golf course etc.

Once you have prepared this list you can give it to your chosen estate agents so that they will know exactly which properties ‘on their books’ you could be interested in.

Step 2: View properties

You will be given a selection of properties by your real estate agent – including several that do not match your criteria. Be strict about viewings as they can be very time-consuming – especially because of the distances needed to travel between them. Only book a couple of viewings per day as it will be both tiring and confusing.

Take a notebook and make notes about each property. Take photos if it will help you to remember the good and bad points about each. If you find a property that you are particularly interested in, arrange a second viewing some days later as this will help to clear your mind about how suitable it will be for you.

Step 3: Make an offer

It is essential that you have all your finances in place before you reach this stage as it puts you in a strong position to negotiate the selling price. You are in a very strong position if you have no property to sell and will be a cash buyer. At this stage, you should tell the estate agent if you have any conditions to make with the offer, for example something that needs renewing or repairing or planning permission being accepted for a swimming pool or extra room. Your real estate agent is responsible for the negotiations about price.

Step 4: Signing the Notaire’s Promesse de Vente (or the older Compromis de Vente)

The Promesse de Vente (which is now used instead of the older Compromis de Vente) contains the following information:

- Full personal details of the sellers and buyers including date and place of birth, marital status

- Confirmation of the ownership of the property with the title deeds.

- A full description and plans of the property, its buildings and the parcels of land being sold.

- A full list of fixtures and fittings included in the sale.

- A financial breakdown of the selling price of the property, the estate agent’s commission and the Notaire’s fees (usually 7-10% of the agreed selling price)

- A full explanation of circumstances that will result in the deposit being forfeited or other penalties– for example, if the buyer changes their mind. The obligations of the vendor will also be detailed

- Any provisional conditions

The deposit amount will be required from the buyer which is usually between 5% and 10% and retained by the Notaire. A completion date will be decided. This date however is not legally binding and can be changed by mutual consent of the vendor and buyer.

A meeting will be arranged at the vendor’s Notaire (solicitor) for you and the vendor with the estate agent present. At this stage, you should have appointed your own Notaire for the property purchase and it can certainly save time to appoint the same Notaire.

Some Notaires and estate agents speak some English, but it is very beneficial if you can speak some French. The Notaire will have the Promesse de Vente document displayed on a large computer screen and will go through it page by page and will ensure that you understand the information given.

One of the most important sections is the DDT (meaning the Dossier de Diagnostic Technique). All house owners are legally obliged to have a series of diagnostic tests performed when they put their house on the market. The report analyses the results of various tests that have been undertaken which include a check for lead asbestos in any parts of the building, electrical conformity, sanitation (waste water) dry rot and termite infestation amongst many others. The Diagnostics also assess the overall energy efficiency and consumption of the property – primarily heating and loss. The property’s energy efficiency is given a grade between A – G with (A being the highest).

Once the Promesse de Vente has been signed by both parties, a deposit of 5% – 10% is paid by the buyers to the Notaire and the property is taken off the market.

Following signing of the Promesse de Vente, an official copy is received by the buyers following receipt of which, there is a ten day ‘cooling off period’ when the buyer can change their mind.

This important document is the first of two legally binding documents and is a contract of sale which binds both the seller and the buyer. The 10% deposit needs to be transferred to the Notaire’s bank account on this day too.

Step 5: The Acte de Vente

This final stage of the house purchase usually takes place about three-four months after signing the Promesse de Vente. The Acte de Vente is drawn up the Notaire and the signing will take place in their office. Both the vendor and buyer must be present and the estate agent.

As the buyer, it is essential that the balance of the cost of the property has been transferred to the Notaire’s bank account, prior to the signing because the Notaire cannot accept checks or cash on the day.

You will also be required to provide proof that you have insured the property from the day of the Acte de Vente.

Congratulations!

Once the Acte de Vente has been signed by both parties, you will be the legal owner of your dream house in France.

The impact of Brexit

The post-Brexit requirements for British nationals moving to France have changed and it is important to fully understand their implications before you buy a property in France. At present, UK nationals are only allowed to live in France for a maximum of 90 days (three months) and if they would wish to stay longer, they must in advance for a long-stay visa.

House buyers from other non-EU countries including Canada, Australia and the United States can currently live in France for 1 to 4 years, but will also have to apply for French residency if they wish to live longer in France.

Dreaming of moving to France? Before making the move, read up on what it’s like living in France as an expat.